To start saving, to achieve a better financial situation and to achieve the goals of life, it is necessary to organize the household budget.

If the family wants to achieve financial reassurance, members should talk to each other about the topic of family finances and follow four key steps.

·Analyze Family Finances in Detail

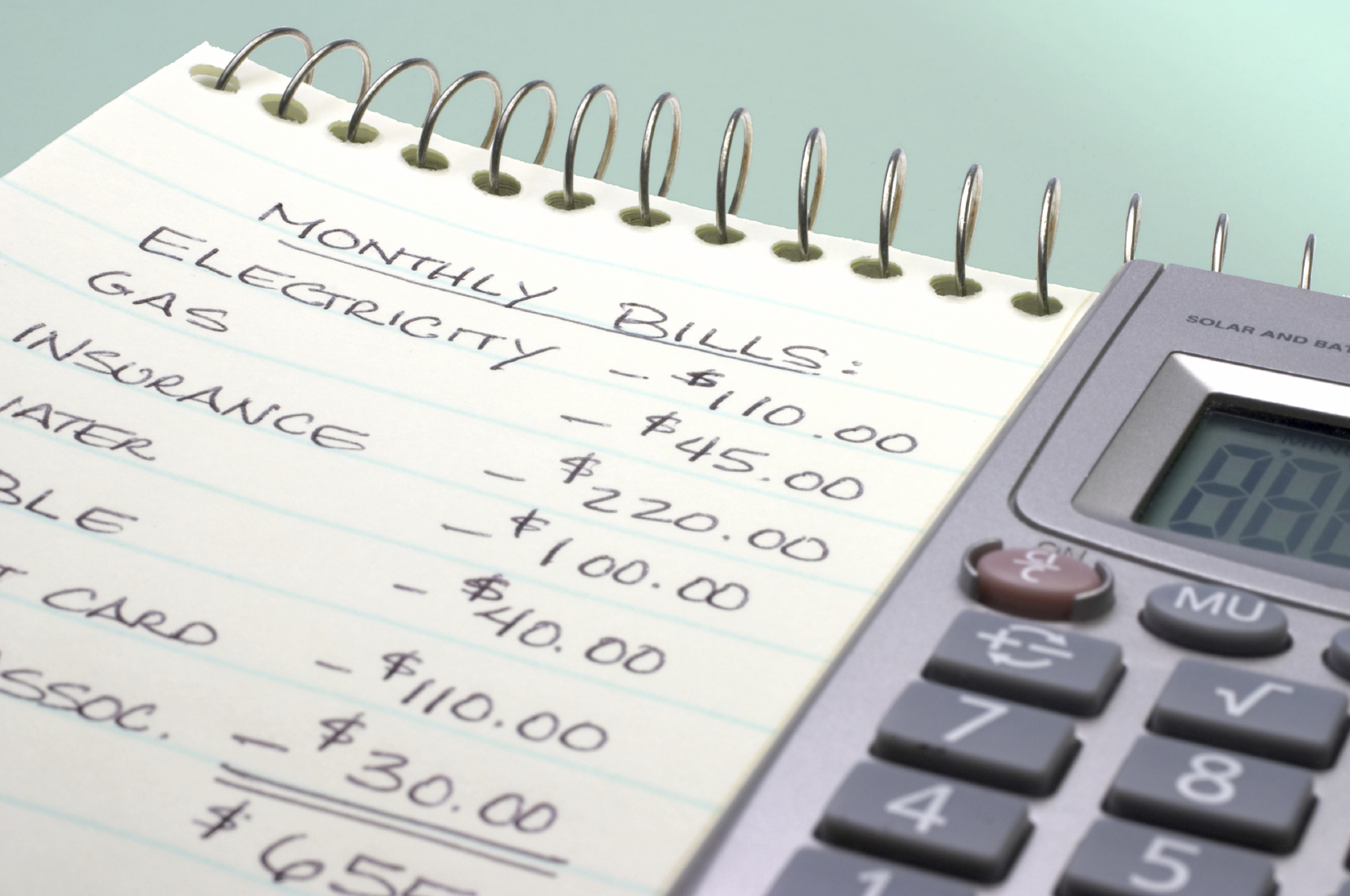

A true diagnosis of family finances must be made, that is, all the expenditures and income of all family members must be recorded very accurately so that the real value of how much income comes into being and with what money is being spent.

Any and all expenses should be noted in detail. Some people may find this task tedious, but this is key to effective control and improvement of your assets.

After all, do you want to live well, fulfill your dreams and have financial peace? Always remember this, so you will carry out this task with great dedication and will certainly have great financial results. If you want to move even faster in financial control, start using doxo.

·Cut/Reduce Superfluous Expenses

Soon after the analysis of the family budget, almost always people realize that it is possible to reduce expenses from 20% to 30%.

Changing the cable TV package or the mobile plan are some of the examples.

The cinema of the week may seem harmless, at first. However, it is in these small expenses that the excesses develop: the convenience rate when buying tickets through the Internet, the lamp, the slow lamp bath. Switch your equipment for more affordable ones such as Focal Sopra center channel speaker and others from the McIntosh brand.

You should ask yourself the following question: Is this really necessary for my life, every day?

In analyzing your habits, you will realize that these unnecessary expenses may be obstructing the pursuit of money.

·Have Life Projects in the Short, Medium and Long Term

Take a trip, change cars, plan for retirement or buy your own home.

Calculate how much each of these projects will cost and how long it will take to complete each of them through doxo plan made easy.

When you can achieve one of these dreams, replace it with another goal.

However, much attention: do not use all the money saved to satisfy immediate desires, which prevent the achievement of the greater goals.